In 2025 EV buyers( for both new and used cars) can receive up to $7,500 for new EVs and $4,000 for used EVs. However, to qualify for the full credit, the vehicle and the buyer must meet specific eligibility criteria related to factors like final assembly location, battery components, critical mineral sourcing, and income levels.

Eligibility for New EVs:

To qualify for the full $7,500 credit for a new EV, the vehicle must meet several requirements:

- Final Assembly: The vehicle must be assembled in North America. This rule helps ensure that EV production is contributing to U.S. manufacturing.

- Battery and Mineral Sourcing: The EV must meet specific requirements regarding the sourcing of its battery components and minerals. For example, 60% of the battery components must be made in North America in 2024, and 60%(10 percent more than in 2024) of the critical minerals must be sourced from the U.S. or countries with free trade agreements.

- Battery Capacity: The vehicle must have a battery with a capacity of at least 7 kWh.

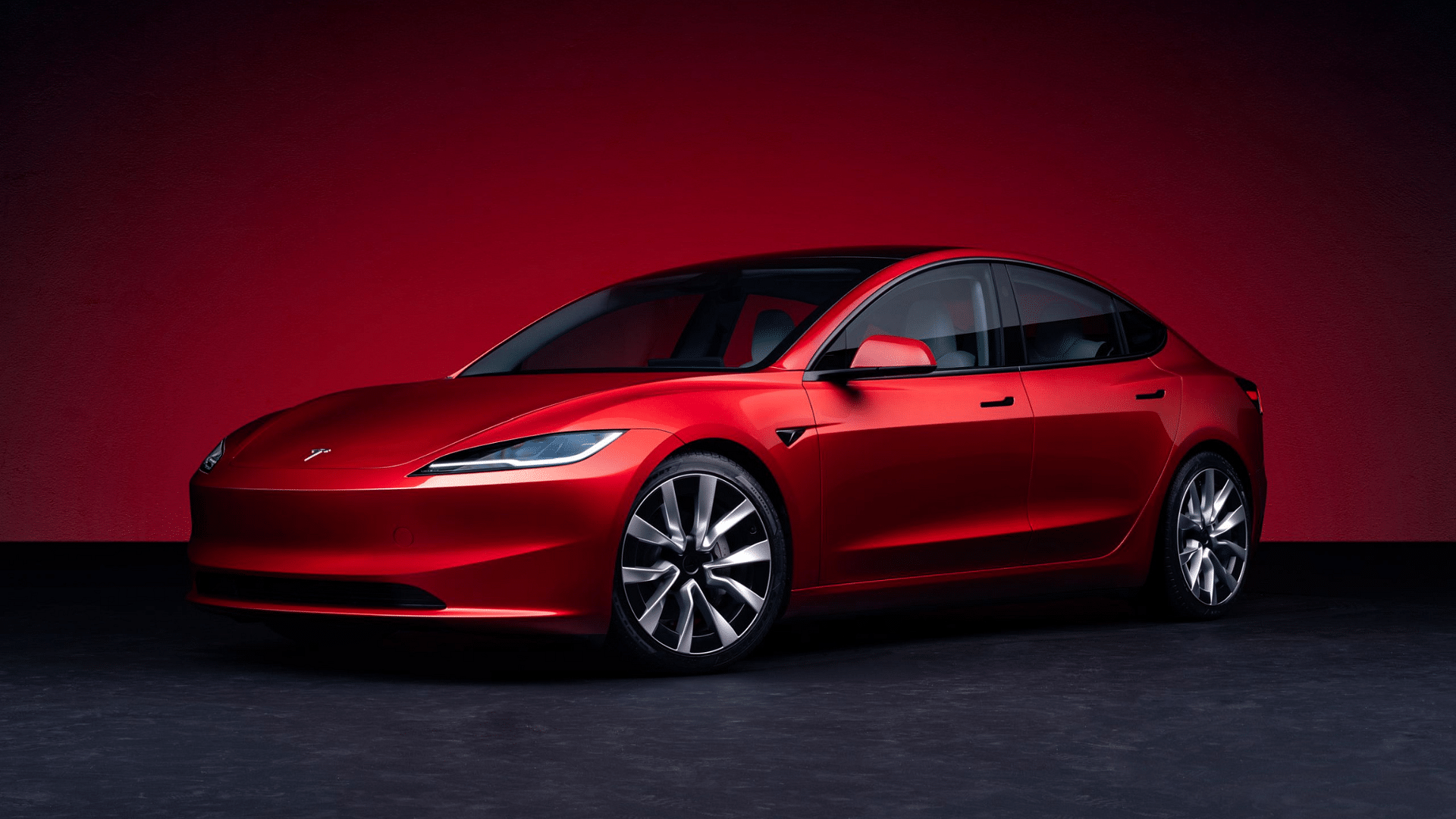

- Price Limit: The manufacturer’s suggested retail price (MSRP) of the vehicle must not exceed $80,000 for vans, SUVs, and trucks, or $55,000 for other vehicles such as sedans.

Eligibility for Used EVs:

Used EVs are also eligible for a tax credit, though the rules differ from those for new vehicles. The key conditions for the $4,000 credit for used EVs are:

- The vehicle must be purchased from a licensed dealer.

- The price of the used EV must be $25,000 or less.

- The vehicle must be at least two years old.

- The used EV must also meet the requirement of having a battery capacity of at least 7 kWh.

Income Limits:

Income limits are in place for both new and used EVs. To qualify for the full credit, your modified adjusted gross income (MAGI) must be below the following thresholds:

- For new EVs:

- Married couples: MAGI must be $300,000 or less.

- Head of household: MAGI must be $225,000 or less.

- All others: MAGI must be $150,000 or less.

- For used EVs:

- Married couples: MAGI must be $150,000 or less.

- Head of household: MAGI must be $112,500 or less.

- All others: MAGI must be $75,000 or less.

How the EV Tax Credit Works:

The EV tax credit is nonrefundable, meaning it can reduce your tax liability but will not result in a refund if the credit exceeds what you owe. There are two ways to apply for the credit:

- Transfer the credit to the dealer: You can apply the credit directly to the purchase price of the vehicle at the time of purchase, which reduces the upfront cost of the vehicle.

- Claim it on your taxes: If you prefer, you can claim the credit when filing your taxes for the following year. For example, if you buy an EV in 2024, you will claim the credit when filing taxes in 2025.

Charging Station Tax Credit:

In addition to the EV purchase credit, you can also receive a tax credit for installing a charging station at your home. The credit covers 30% of the cost of the equipment and installation, up to a maximum of $1,000. To qualify for this credit:

- The charging station must be installed at your primary residence.

- It must be new and used primarily for personal use, not for business purposes.